|

| How AI and ML Are Transforming Finance |

AI and ML, short

for Artificial Intelligence and Machine Learning, are transforming the world of

finance. AI is like having a super-smart computer that can learn and make

decisions on its own. It uses vast amounts of data to predict financial trends

and manage risks, making it easier for people to invest wisely and keep their

money safe. ML, its helper, learns from this data, getting even better at

making predictions over time. Together, AI and ML are transforming finance

by providing smart, data-driven solutions for better financial management and

investment decisions. They're like having financial experts at your service,

guiding you toward smarter financial choices.

In this article, you'll discover the remarkable impact of Artificial Intelligence (AI) and Machine Learning (ML) on the world of finance. AI, like a digital financial guru, uses its incredible abilities to analyze massive amounts of data and predict financial trends. It helps individuals and businesses make informed investment decisions while managing risks more effectively and learn How AI and ML Are Transforming Finance and what isAI in finance.

This article delves into the benefits of these technologies, such as improved risk management, 24/7 customer support, and personalized financial advice. It also discusses the future potential of AI and ML in finance, AI and ML Are Transforming Finance, making it a must-read for anyone interested in staying ahead in the rapidly evolving world of financial technology. Whether you're an investor, a financial professional, or simply curious about the future of finance, this article will provide valuable insights into the powerful role AI and ML are playing in shaping the industry.

Data Science AI and ML In Finance

In the realm of finance, where precision, timing, and insights are paramount, data science, artificial intelligence (AI), and machine learning (ML) have emerged as the ultimate game-changers. These technologies have revolutionized the financial industry, redefining the way businesses make decisions, manage risks, and optimize their operations.

|

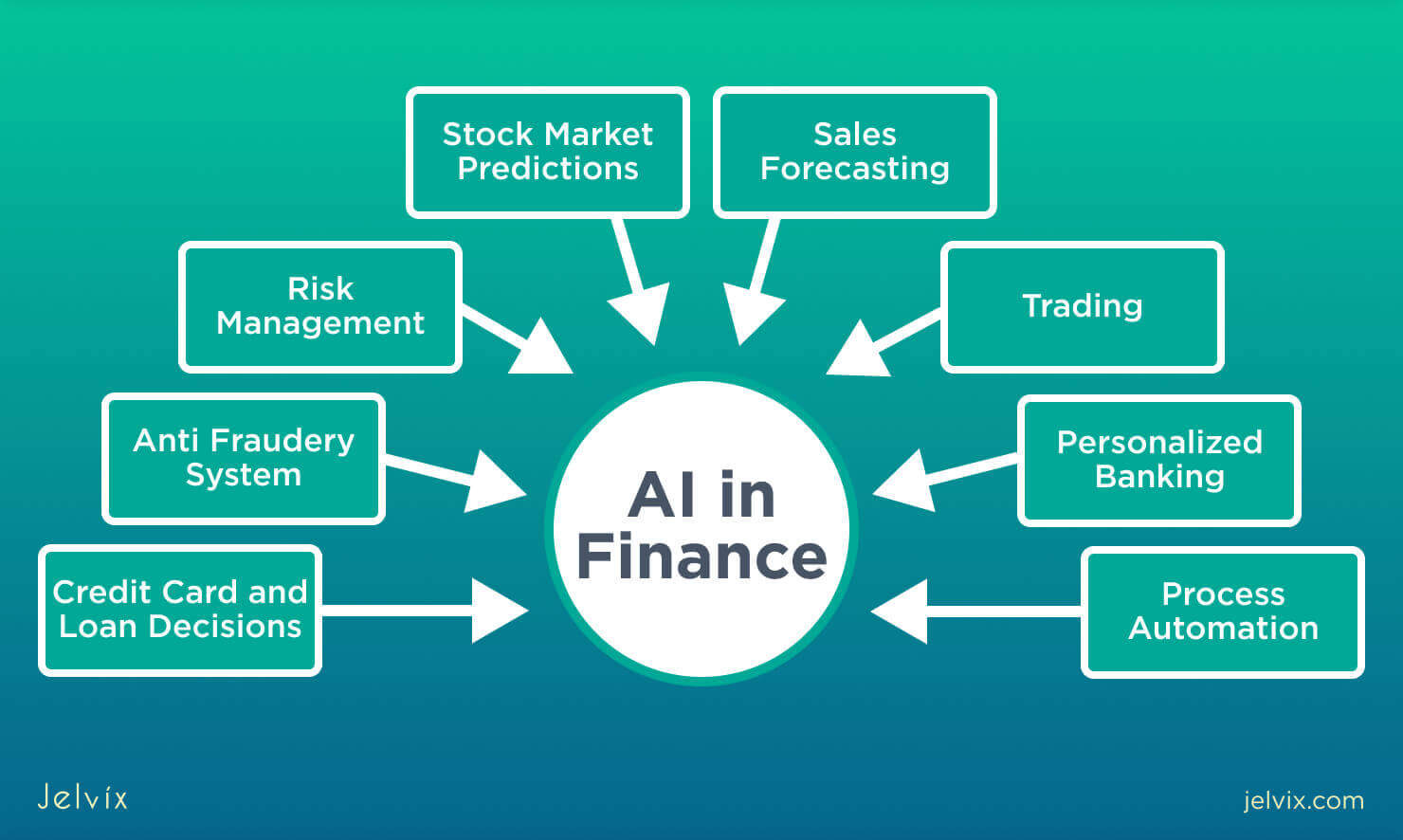

| How AI and ML Are Transforming Finance: What Is AI in Finance(image source by jelvix) |

The Financial Revolution Powered by Data Science and AI

To comprehend the

magnitude of this revolution, consider this: according to a study by PwC,

nearly 75% of financial service providers believe that AI will be a

game-changer for their industry. The same study reveals that AI is expected to

contribute over $1 trillion to the global economy through increased

productivity and product innovation.

Here, we explore how

data science, AI, and ML are driving change in finance and how businesses can

harness their potential to maximize profits and foster innovation.

Read more here about a Tch revolution in the world of Finance.

Data-Driven Decision-Making in Finance World

Data science has

bestowed upon financial institutions the power of data-driven decision-making.

In a sector where microseconds can make or break fortunes, access to real-time

data and the ability to analyze it swiftly can make all the difference.

AI algorithms can sift

through mountains of financial data, identifying trends and anomalies that

human analysts might miss. For instance, AI-driven trading systems can process

vast datasets of historical market information, enabling traders to make split-second

decisions based on patterns and correlations. These systems can execute trades

at speeds and frequencies far beyond human capabilities, unlocking once

unimaginable profit opportunities.

Risk Management and Fraud Detection( AI and ML in Finance World)

Risk management is a

core function in finance, and AI and ML have significantly enhanced this

critical area. Machine learning models can analyze historical data to predict

market volatility, assess credit risk, and optimize investment portfolios. This

not only helps investors minimize potential losses but also maximizes returns.

Moreover, AI is a

potent weapon in the battle against fraud. Financial institutions lose billions

of dollars annually to fraudulent activities. AI algorithms can detect

suspicious patterns and transactions in real-time, flagging potential fraud

cases long before they escalate. A report by McKinsey & Company estimates

that AI-powered fraud detection could reduce financial fraud losses by 40%.

|

| How AI and ML Are Transforming Finance: What Is AI in Finance |

Personalized Financial Services with the AI/ML

AI is also reshaping

how financial services are delivered to customers. Chatbots and virtual

assistants powered by natural language processing (NLP) are becoming

commonplace in customer service. These AI-driven agents can handle routine

inquiries, assist with transactions, and provide financial advice, enhancing

customer experiences while reducing operational costs.

Additionally,

recommendation systems, similar to those used by technology giants like Amazon

and Netflix, are gaining ground in finance. Banks and investment firms employ

recommendation algorithms to suggest personalized financial products, such as

investment opportunities or credit cards, to customers based on their financial

histories and goals. This not only increases cross-selling opportunities but

also enhances customer satisfaction.

|

| How AI and ML Are Transforming Finance: What Is AI in Finance |

Quantitative Trading and Algorithmic Investments for Finance

Quantitative trading,

driven by complex algorithms and machine learning models, has become a dominant

force in financial markets. These algorithms analyze historical and real-time

data to execute trading strategies automatically. The advantages are clear:

they remove human emotions from trading decisions and can identify

opportunities across multiple markets simultaneously.

High-frequency trading (HFT) is a prime example of AI and ML in action. HFT firms leverage cutting-edge technology to execute trades at blazing speeds, often in microseconds. They use machine learning models to predict market movements, arbitrage price differences, and manage risk in real-time. These strategies have resulted in substantial profits for HFT firms, with some estimates suggesting they account for nearly half of all U.S. equity trading volume.

Maximizing Profits with AI and ML

Now that we've seen

how data science and AI have reshaped finance, the question arises: how can

businesses maximize their profits in this data-driven era? The answer lies in

leveraging these technologies effectively.

1. Investment in AI Infrastructure

To fully harness the

power of AI and ML, financial institutions must invest in robust

infrastructure. This includes high-performance computing clusters, data storage

solutions, and scalable cloud platforms. By ensuring the availability of these

resources, organizations can process vast datasets quickly and run complex machine-learning

models efficiently.

2. Data Quality and Governance

High-quality data is

the lifeblood of AI and ML applications. Financial organizations should focus

on data governance practices, ensuring data accuracy, consistency, and

security. Data cleansing, validation, and monitoring processes should be in

place to maintain data integrity.

3. Talent Acquisition and Training

The demand for data

scientists and AI specialists is on the rise. Financial institutions should

actively recruit and train professionals in these fields. Training existing

employees in data science techniques is also a viable strategy to build

in-house expertise.

4. Regulatory Compliance

The financial industry

is heavily regulated, and AI applications must comply with stringent rules and

standards. It's crucial to integrate compliance into AI development processes

to ensure that algorithms meet legal and ethical requirements.

New Business Ideas in the Age of AI and ML Are Transforming Finance / Data Science

Beyond traditional

financial institutions, there are vast opportunities for entrepreneurs and

startups to leverage AI, ML, and data science. Here are some exciting business

ideas:

1. AI-Driven

Robo-Advisors: Launch a

robo-advisory platform that uses AI algorithms to provide personalized

investment advice and portfolio management for individuals.

2. Alternative

Credit Scoring: Develop an

AI-powered credit scoring system that uses non-traditional data sources, such

as social media and transaction histories, to assess creditworthiness for

underbanked populations.

3. Peer-to-Peer

Lending Platforms: Create a

P2P lending platform that employs AI for risk assessment and automated loan

processing, connecting borrowers with individual or institutional lenders.

4. Insurtech

Innovations: Enter the

insurance technology (insurtech) space by developing AI-driven solutions for

claims processing, fraud detection, and personalized policy recommendations.

5. AI-Powered

Trading Tools: Build

sophisticated trading tools and algorithms that cater to retail investors,

empowering them to make data-driven investment decisions.

Strategies for Success( AI and ML in the Finance World)

Starting and growing a

business in the fields of AI, ML, and data science can be incredibly rewarding

but also challenging. Here are some strategies for success:

1. Niche Focus: Specialize in a specific niche within the

financial industry, such as alternative investments or sustainable finance.

This allows you to become an expert in a particular area and stand out in the

market.

2. Collaboration: Partner with established financial

institutions or technology firms to gain access to resources, data, and

distribution channels.

3. Regulatory

Compliance: Understand and

adhere to financial regulations. Consult legal experts to ensure your

AI-powered solutions meet compliance requirements.

4. Continuous

Learning: Stay updated with

the latest advancements in AI and data science. Attend conferences, webinars,

and training programs to keep your knowledge and skills up-to-date.

5. Ethical

Considerations: Build ethical

AI systems. Transparency, fairness, and responsible data usage are essential

for gaining trust in the financial industry.

Conclusion: Shaping the Future of Finance with AI and Data Science

As we look to the

future, it's evident that data science, artificial intelligence, and machine

learning will continue to be pivotal in shaping the financial landscape. Their

ability to analyze data, optimize processes, and enhance decision-making

positions them as indispensable tools in the industry's toolbox.

Whether you're a

financial institution aiming to maximize profits, an entrepreneur seeking new

business opportunities, or a data scientist passionate about innovation, the

world of finance offers fertile ground for exploration. By embracing AI, ML,

and data science with a commitment to ethics and excellence, we can build a

financial future that's more accessible, efficient, and profitable for all.

The journey is just

beginning. Let's embark on it with open minds and a determination to harness

the full potential of these transformative technologies to revolutionize

finance for generations to come.

.png)

COMMENTS